Cash App offers more than just sending and receiving money. It now lets some users borrow small amounts quickly. This feature can help when you need extra cash fast.

Cash App Borrow lets eligible users get up to $200 in minutes with a 5% flat fee. The app checks if you can use this option. Not everyone has access to it yet.

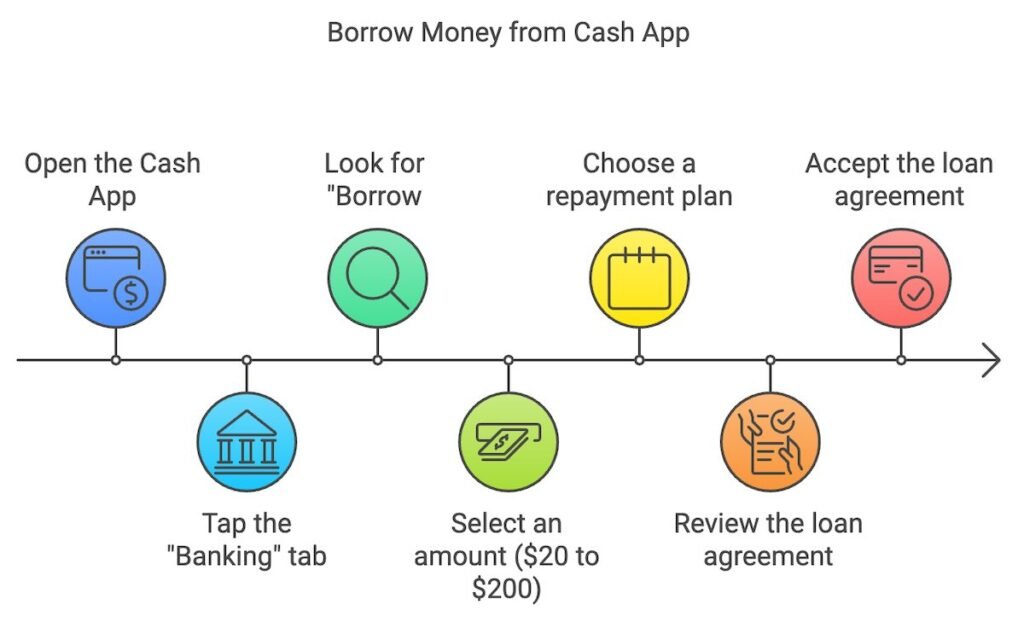

To borrow money from Cash App, users open the app and look for the Borrow option. If it’s there, they can request a loan. The money goes straight into their Cash App balance. Repayment happens automatically on the due date from the linked bank account.

Understanding Cash App

Cash App is a popular mobile payment service created by Block, Inc. (formerly Square, Inc.). It allows users to send and receive money quickly and easily.

The app offers various financial services beyond simple money transfers. Users can buy and sell stocks, purchase Bitcoin, and even get a physical debit card linked to their Cash App balance.

Cash App has gained popularity due to its user-friendly interface and quick setup process. To use the app, users need to link a bank account or debit card.

One unique feature of Cash App is its ability to borrow money. This service is not available to all users and depends on factors like account history and usage.

Cash App uses encryption to protect users’ personal and financial information. It also offers security features like PIN protection and fingerprint ID.

The app generates revenue through transaction fees, subscription services, and its Bitcoin exchange. It’s important to note that while basic peer-to-peer transfers are free, some services may incur fees.

Cash App has become a significant player in the fintech industry, competing with services like Venmo and PayPal. Its growth has been driven by its ease of use and expanding range of financial services.

Eligibility Requirements for Borrowing

Cash App sets specific criteria for users to qualify for its borrowing feature. These requirements aim to ensure responsible lending and minimize risks for both the platform and borrowers.

Age and Location Criteria

To borrow money from Cash App, users must be at least 18 years old. This age requirement is a standard practice in financial services to ensure legal compliance.

Cash App’s borrowing feature is only available to users in the United States. The company has not yet expanded this service to other countries.

Users need to have a valid U.S. address on file with Cash App. This helps verify identity and establish residency within the service area.

Account Activity and History

Cash App looks at a user’s account activity when deciding loan eligibility. Active users are more likely to qualify for borrowing.

Regular transactions on the app, such as sending and receiving money, can improve chances of approval. Cash App may also consider the frequency and amount of these transactions.

The length of time a user has had their Cash App account can play a role. Older accounts with consistent activity may have an advantage.

Creditworthiness Considerations

Cash App does not perform a traditional credit check for its borrowing feature. This makes it accessible to users who might have limited credit history.

Instead, Cash App uses its own internal scoring system. This system likely takes into account factors like account balance, transaction history, and repayment of previous Cash App loans.

Users who have borrowed from Cash App before and repaid on time may have a higher chance of approval for future loans. Timely repayments can potentially increase borrowing limits over time.

How to Apply for a Loan on Cash App

To apply for a loan on Cash App, start by opening the app on your phone or tablet. Look for the “Borrow” option on the home screen or under the “Banking” tab.

If you see the Borrow option, tap on it to begin the process. Cash App will then prompt you to unlock the borrowing feature.

Next, select the loan amount you wish to borrow. Cash App offers different loan amounts based on eligibility.

Choose a repayment plan that fits your budget. Cash App typically provides several options for repayment schedules.

Carefully review the loan agreement. Make sure to understand the terms, interest rates, and any fees associated with the loan.

If everything looks good, accept the loan agreement. Cash App will then process your application.

Upon approval, the funds will be added to your Cash App balance. Users can then use the money as needed or transfer it to their linked bank account.

Remember that not all Cash App users have access to the Borrow feature. Eligibility depends on various factors determined by Cash App.

Loan Amounts and Terms

Cash App Borrow offers short-term loans with flexible options. The loan amounts, repayment periods, and fees vary based on eligibility and other factors.

Minimum and Maximum Loan Amounts

Cash App Borrow lets users take out loans between $20 and $200. The exact amount available depends on the user’s account history and activity. New users may start with lower limits, while frequent users might qualify for higher amounts.

Cash App assesses each user’s eligibility individually. Factors like regular deposits and account usage can influence the maximum loan amount offered.

Repayment Period Options

Cash App Borrow typically offers a 4-week repayment period. This means borrowers have about a month to pay back the loan.

Some users may have the option to extend their repayment period. However, this can result in additional fees. It’s important to check the specific terms offered when applying for a loan.

Cash App may send reminders as the due date approaches. Setting up automatic payments can help ensure timely repayment.

Interest Rates and Fees

Cash App Borrow charges a flat fee instead of traditional interest. The fee is typically 5% of the borrowed amount. For example, borrowing $100 would incur a $5 fee.

Late payments may result in additional charges. Cash App clearly displays the total amount due, including fees, before finalizing the loan.

There are no hidden costs or prepayment penalties. Users can repay their loans early without extra charges. This transparency helps borrowers understand the full cost of the loan upfront.

Repayment Process

Cash App loans have specific rules for paying back borrowed money. The app offers options to make repayments easy and on time.

Automatic Deductions

Cash App sets up automatic payments from the linked bank account. These happen on the due date each week. The app sends reminders before taking out money. Users can change the payment amount if needed.

Automatic deductions help avoid late fees. They ensure timely payments without extra effort. Users should keep enough money in their account to cover the weekly amount.

Cash App may offer a grace period for insufficient funds. This varies based on individual accounts and payment history.

Manual Repayments

Cash App also allows manual payments. Users can pay extra or the full amount early. To make a manual payment, open the app and go to the Borrow tab. Select “Make a Payment” and choose the amount.

Manual payments give more control over repayment. They can help pay off the loan faster. This method works well for those who prefer to manage payments themselves.

Users should check their loan terms. Some loans might have fees for early repayment.

Consequences of Missing Payments

Missing payments can lead to fees and penalties. Cash App may charge late fees for each missed payment. The exact amount depends on the loan terms.

Repeated missed payments can affect future borrowing ability. Cash App might lower borrowing limits or deny future loans.

Late payments could impact credit scores if reported. Cash App doesn’t always report to credit bureaus, but it’s best to pay on time.

If struggling with payments, users should contact Cash App support. They might offer options like payment plans or extended deadlines.

Security and Privacy Considerations

Cash App takes steps to protect users’ personal and financial information. They use encryption to secure data and offer two-factor authentication for added account security.

When borrowing money through Cash App, users should be cautious about sharing their login details. It’s important to keep passwords and PIN numbers private.

Cash App may collect and use certain personal data when processing loan applications. Users should review the app’s privacy policy to understand how their information is handled.

Borrowers should be aware of potential scams. Cash App will never ask for login credentials or sensitive information via email, text, or phone calls.

It’s wise to monitor account activity regularly and report any suspicious transactions immediately. Cash App provides in-app support for security concerns.

Users should ensure they’re using the official Cash App from a trusted app store. Fake apps can pose security risks.

When repaying loans, it’s crucial to use only the official Cash App platform. This helps protect financial information and ensures proper credit for payments.

By following these security practices, users can borrow money from Cash App more safely while protecting their personal and financial data.

Cash App Borrow vs. Traditional Lending

Cash App Borrow offers a quick and easy way to get small loans. Users can borrow up to $200 directly through the app. This process is much faster than traditional lending.

Traditional lenders often require more paperwork and longer approval times. They may also check credit scores, which Cash App Borrow doesn’t do.

Cash App loans have a flat 5% fee and must be repaid within 4 weeks. Traditional loans might have lower interest rates for those with good credit. However, they often come with longer repayment terms.

Here’s a quick comparison:

| Feature | Cash App Borrow | Traditional Lending |

| Loan Amount | Up to $200 | Varies, often higher |

| Application | In-app, fast | More extensive |

| Credit Check | No | Usually required |

| Approval Time | Minutes | Days to weeks |

| Fees | 5% flat fee | Varies by lender |

| Repayment | 4 weeks | Months to years |

Cash App Borrow is best for small, short-term loans. Traditional lending might be better for larger amounts or longer repayment periods.

Eligibility for Cash App Borrow depends on factors like account activity. Not all users can access this feature. Traditional lenders typically have more universal eligibility criteria.

Customer Support and Dispute Resolution

Cash App offers various ways to get help with borrowing issues. Users can contact support through the app or by calling 1-800-969-1940.

For disputes related to Cash App Card transactions, customers can file a dispute in the app. This process involves a few simple steps:

- Go to the Activity tab

- Select the transaction in question

- Tap the three dots (…)

- Choose “Need Help & Cash App Support”

- Select “Dispute this Transaction”

Customers can check the status of their dispute at any time. If they need to cancel a dispute, they should contact support directly.

For refunds on purchases, users should first contact the merchant. If unsuccessful, they can then reach out to Cash App support for further assistance.

Cash App’s customer support team is trained to handle a variety of issues, including those related to borrowing money through the app. They can provide guidance on eligibility, repayment terms, and any other concerns users may have.

Frequently Asked Questions

Cash App’s borrowing feature has specific requirements and steps. Users often have questions about eligibility, device compatibility, and repayment terms.

What steps are needed to unlock the borrow feature on Cash App?

To unlock the borrow feature, open Cash App and go to the “Banking” section. Look for “Borrow” and tap it. If available, tap “Unlock” to see your loan options.

Select a loan amount and repayment plan. Review and accept the loan agreement to complete the process.

Can I borrow money through Cash App on my Android device?

Yes, Android users can borrow money through Cash App. The borrowing process is the same for both Android and iOS devices.

Open the app, navigate to the “Banking” tab, and check for the “Borrow” option. If present, you can proceed with the loan application.

Why might I be unable to access the Cash App borrow feature?

The borrow feature is not available to all Cash App users. Eligibility depends on factors like account activity and state regulations.

If you don’t see the “Borrow” option, you may not qualify. Cash App determines eligibility based on their criteria.

What is the process for borrowing money on Cash App without a card?

You don’t need a Cash App card to borrow money. The borrowing process uses your Cash App account, not the physical card.

Follow the same steps to access the “Borrow” feature in the app. If eligible, you can apply for a loan without having a Cash App card.

How does repayment work when you borrow money from Cash App?

Cash App offers flexible repayment options. When you borrow, you choose a repayment plan that fits your budget.

Payments are automatically deducted from your Cash App balance. You can make extra payments or pay off the loan early without penalties.

Is it possible to receive funds on Cash App before paying off an existing borrow balance?

Yes, you can still receive funds in your Cash App account while you have an outstanding borrow balance. The loan doesn’t affect your ability to receive money.

Keep in mind that Cash App may use incoming funds to cover scheduled loan payments. It’s important to maintain sufficient balance for repayments.